In this guide, we’ll walk you through the process of Stripe mobile app integration, from setup to implementation. Get ready to transform your app into a seamless payment powerhouse.

Why Stripe for Mobile Apps?

Streamlined Integration Process

Stripe’s developer-friendly SDK stands out as a key feature. The integration process is straightforward, with clear documentation and sample code available. This allows you to set up your payment system quickly, without compromising on quality or security.

Comprehensive Payment Options

Stripe supports numerous payment methods. In the United States, for example, you can accept Visa, Mastercard, American Express, Discover, JCB, Diners Club, and China UnionPay. This versatility proves crucial for apps with a global user base.

Advanced Fraud Prevention

Security takes center stage in mobile payments. Stripe’s machine learning-based fraud detection system, Radar, monitors transaction data and looks for patterns or anomalies that may indicate friendly fraud. This proactive approach helps businesses reduce chargebacks compared to their previous payment processors.

Subscription Management

For apps that offer recurring services, Stripe’s subscription tools prove invaluable. These tools handle everything from billing cycles to failed payment retries.

Real-time Analytics

Stripe provides detailed, real-time reporting on transactions, which proves crucial for making data-driven decisions. Businesses use these insights to optimize pricing strategies and identify their most valuable customer segments.

Customizable UI Components

Stripe Elements allows for the creation of custom payment forms that match your app’s design. This consistency in user experience leads to improved conversion rates.

Seamless Updates and Maintenance

Stripe regularly updates its SDK to introduce new features and security enhancements. This ongoing support ensures that your app’s payment system stays current without requiring constant attention from your development team.

While other payment solutions exist (such as PayPal or Square), Stripe often emerges as the top choice for its combination of ease of use, robust features, and scalability. Its ability to grow with your business makes it an excellent option for startups and established companies alike.

As we move forward, let’s explore the practical steps to set up Stripe in your mobile app and harness its full potential.

How to Set Up Stripe in Your Mobile App

Create Your Stripe Account

Start by signing up for a Stripe account on their official website. The registration process requires basic information about your business, including your company name, address, and tax ID. After setting up your account, navigate to the Developers section of your Stripe Dashboard. Here, you’ll find your API keys (a publishable key and a secret key). These keys are essential for integrating Stripe into your app, so store them securely.

Install the Stripe SDK

iOS developers can add the Stripe SDK to their project using CocoaPods. Add the Stripe pod to your Podfile and run the installation command. Android developers should include the Stripe SDK in their app’s build.gradle file by adding the implementation line with the latest version number.

Configure Security Measures

Security is a top priority when handling payments. Implement SSL pinning to prevent man-in-the-middle attacks. This technique ensures that your app only communicates with verified Stripe servers. Never store sensitive payment information on your servers. Instead, use Stripe’s tokenization feature to securely transmit payment details. Once a customer provides payment data, the tokenization system generates a unique token in place of the actual data.

Set Up Webhook Endpoints

Webhook endpoints are vital for receiving real-time updates about events in your Stripe account. Set up webhook endpoints in your server-side code to handle events like successful payments, failed charges, or disputed transactions. This allows your app to respond dynamically to payment-related events that happen outside of your payment flow.

Test Your Integration

Before launching, thoroughly test your Stripe integration using Stripe’s test mode. This allows you to simulate various payment scenarios without processing real transactions. Use Stripe’s test card numbers to verify that your app handles successful payments, declines, and errors correctly.

PCI DSS compliance standards are non-negotiable when it comes to payment processing. Follow these steps and best practices to offer secure, efficient payment options in your mobile app. In the next section, we’ll explore how to implement Stripe payment flows to create a seamless user experience.

To ensure optimal performance of your Stripe integration, consider implementing effective Web API design and implementation strategies for seamless functionality in your mobile app.

Building Seamless Payment Flows

Design an Intuitive Payment Form

Create a clean, user-friendly payment form. Stripe’s Elements library offers pre-built UI components that you can customize to match your app’s design. These components handle input formatting and validation, which reduces errors and improves conversion rates.

The Card Element automatically formats card numbers as users type, making it easier for them to spot mistakes. Apps using Elements see a 10.5% increase in revenue on average compared to custom-built forms.

Optimize the Payment Submission Process

When a user submits payment information, your app should create a payment method on the client-side using Stripe’s SDK. This generates a token that represents the payment details, which you’ll send to your server for processing.

Here’s an important tip: Always confirm charges on your server, never on the client-side. This prevents malicious users from manipulating the payment amount.

Handle Successful Transactions and Errors

After processing a payment, provide clear feedback to the user. For successful transactions, display a confirmation screen with transaction details and any next steps.

For errors, offer specific guidance on how to resolve the issue. Vague error messages can lead to frustration and abandoned purchases. Stripe provides detailed error codes that you can use to give precise instructions to users.

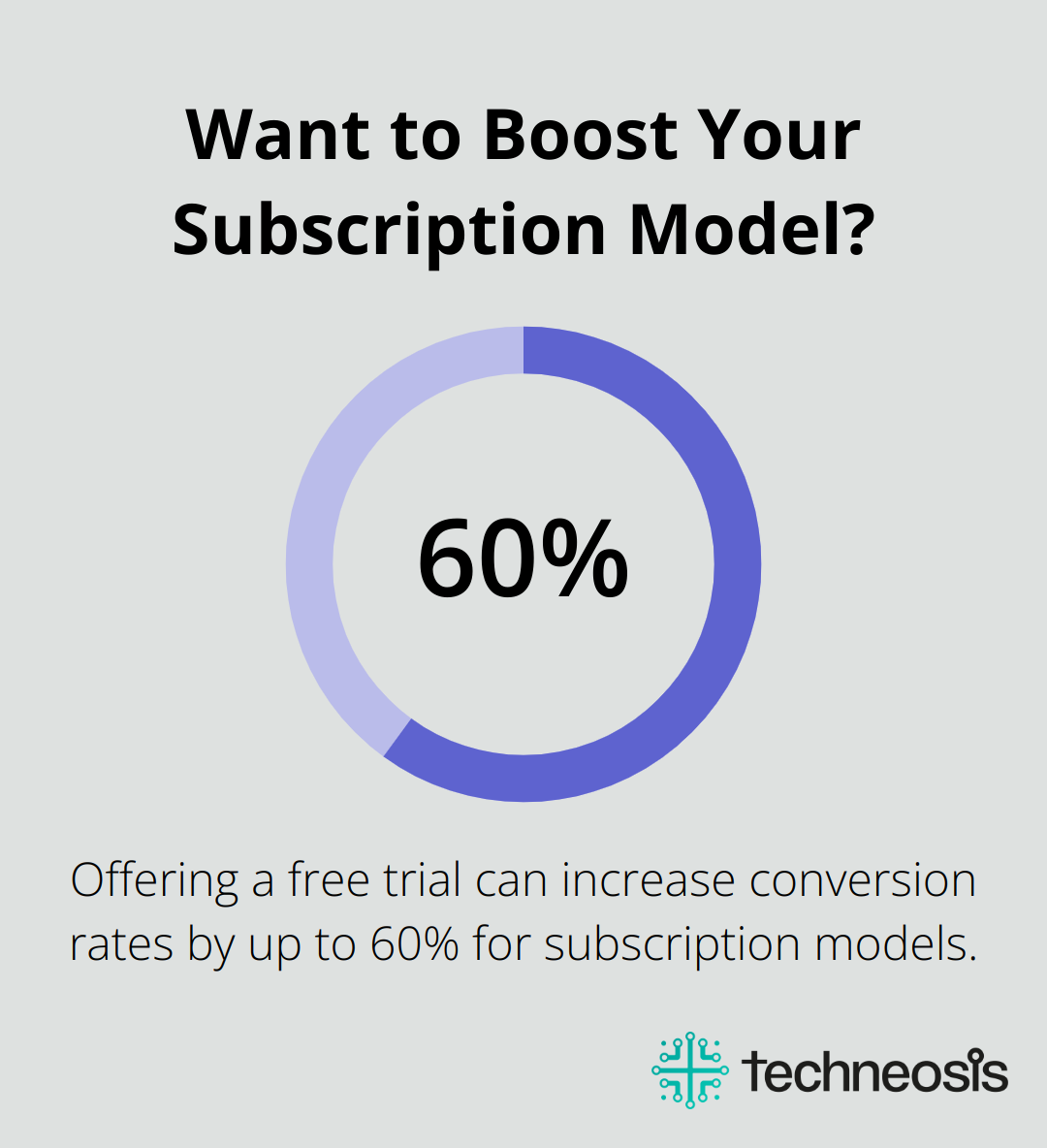

Implement Subscription Models

For recurring payments, use Stripe’s Billing API. This powerful tool manages the entire subscription lifecycle, from initial sign-up to cancellation.

One often-overlooked feature is the ability to offer trial periods. A study by Recurly found that offering a free trial can increase conversion rates by up to 60%. Use the trial_period_days parameter when creating a subscription to easily implement this feature.

Handle subscription events like renewals, cancellations, and payment failures through webhook endpoints. This ensures your app stays in sync with the subscription status on Stripe’s servers.

Enhance Security Measures

Implement additional security measures to protect user data and prevent fraud. Use Stripe’s built-in fraud detection tools (such as Radar) to automatically flag suspicious transactions. Enable 3D Secure authentication for an extra layer of security on high-risk transactions.

Try to implement address verification (AVS) and CVV checks to further reduce the risk of fraudulent charges. These small steps can significantly improve the overall security of your payment system.

Final Thoughts

Stripe mobile app integration unlocks a world of secure, seamless payment possibilities. We covered essential steps from account setup to advanced feature implementation, providing a roadmap for a robust payment system. Security remains paramount: implement SSL pinning, use tokenization, and leverage Stripe’s fraud detection tools to safeguard user information.

Stripe’s Elements library helps create intuitive payment interfaces that boost conversion rates. Clear feedback for transactions and errors guides users through the payment journey. Stripe continues to innovate, offering new features and integrations to optimize your app’s performance (e.g., expanded payment methods and enhanced analytics).

At Techneosis, we understand the intricacies of payment system integration. Our team can guide you through the process, aligning Stripe integration with your business objectives. For assistance with your mobile app development needs, contact us today.